Deciding when to begin taking your Social Security retirement benefits can be difficult because there are many factors to consider. Even if you plan to keep working, benefits are available to most workers as early as age 62, but you can delay collecting each year until age 70.

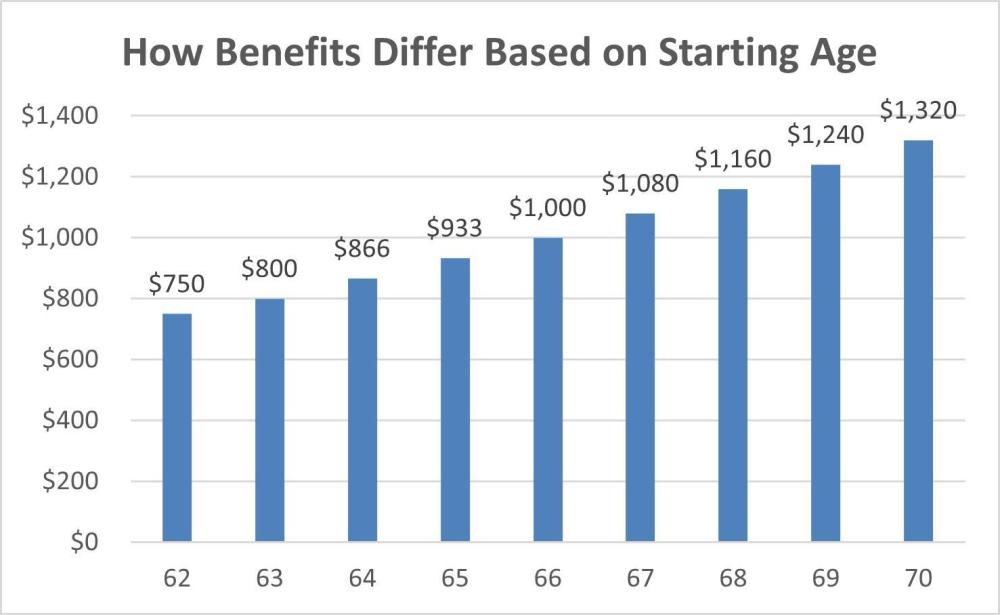

The first step in making a decision is to determine your full retirement age (FRA)—the age at which you can collect your full benefits. For workers born between 1943 and 1954, the FRA is 66; for those born later, the FRA gradually increases to age 67. Claiming benefits prior to your FRA can reduce your monthly payment by as much as 30%—but you will receive benefits for a longer period. If you postpone claiming benefits beyond your FRA, your social security payment will increase by a certain percentage, depending on your year of birth, until you reach age 70.

It’s important to consider your options carefully. The decision to claim benefits early can result in a lower standard of living for the rest of your life. And claiming later can mean more financial security for your surviving spouse.

The benefit reduction incurred by claiming early is permanent. If you elect to start receiving benefits early, your benefits will still be increased annually by cost-of-living allowances. But despite Social Security’s annual inflation adjustment, your payments may never equal the benefit you would have received by waiting until your FRA.

What timeline is best for you? You can crunch the numbers using AARP’s Social Security Benefits Calculator, available at www.aarp.org/retirement/social-security/benefits-calculator.

QUESTIONS TO ASK YOURSELF

From a purely mathematical point of view, most people are better off waiting to start collecting their Social Security benefits, but there are questions you need to ask yourself.

Do you need the cash? If you need help paying for basic living expenses, you probably should elect to begin receiving benefits as soon as possible.

How is your health? According to the most recent Social Security Administration (SSA) life expectancy tables, a healthy 65-year-old female’s average life expectancy is 86.6. Although it is worth mentioning, one out of every four females will live past age 90.

In any case, it is important to consider your family’s pattern of longevity. The longer you live, the more you benefit from delaying. If your health and family history predict a long life, you may be better off delaying your benefits until FRA or later.

If you don’t expect to attain a normal life expectancy and you are single, consider taking benefits early. But if you are married, be aware that doing so will reduce your spouse’s survivor benefit.

Will you continue to work? If your working wages are greater than $18,960 in 2021 and you selected early benefits, your (and your dependents’) social security benefits will be reduced by $1 for every $2 you earn. If you earn more than $50,520 in the year you reach your FRA, your benefits will be reduced by $1 for every $3 you earn. After that point, working does not affect the amount of your benefit, though it may affect whether your benefits are taxed.

Although your benefits will be reduced if your earned income exceeds the threshold, this is a temporary reduction. The SSA will recalculate your benefits at your FRA and credit any months when your earnings from work completely offset your monthly benefit. Furthermore, since your benefit includes your highest 35 years of indexed earnings, wages you earned today may replace lower-earning years in the benefit calculation, which could result in higher benefits.

How much do you earn from pensions and other investments? For retirees earning more than $25,000 ($32,000 for married couples), 50% of your Social Security benefits will be taxed. If you earn more than $34,000 ($44,000 for married couples), 85% of your Social Security benefits will be included in your taxable income. To determine your income for this purpose, the IRS looks at wages, self-employment, interest, dividends, and otherwise tax-free municipal-bond income. The IRS adds all these to one-half of your social security benefit to determine how much of your benefits will be taxed.

Are you in a high tax bracket? Because social security benefits may be taxed, those in the highest tax brackets and with other sources of income can benefit from delaying social security, thus deferring taxes.

Were you or your spouse born in 1953 or earlier? Normally, if both you and your spouse are living, the SSA will pay you the higher of your social security retirement benefit or 50% of your spouse’s benefit. If you were born in 1953 or earlier and delay benefits until your FRA, however, you will have a choice of either benefit.

One strategy would be for the lower-earning spouse to take reduced benefits after age 62 and for the higher-earning spouse to wait to take a spousal benefit at his or her own FRA. Then, at age 70, the latter would switch to a benefit based on their own work history. This would allow you to accrue delayed retirement credits and provide a higher benefit. However, because the rules are somewhat complicated, consult your local social security office about your eligibility for this strategy.

Are you a surviving spouse? As a widow or widower at FRA, you are eligible for 100% of what your spouse’s benefits would have been if they were living. Reduced survivor benefits are available at age 60. Taking a reduced survivor benefit does not affect the benefit based on your own earning history. Thus, you can apply for a survivor benefit and switch to your unreduced retirement benefit at your FRA or later.

Will you spend or save your social security benefits? You may be able to earn more on your reinvested payments than you lose by taking a reduced benefit. A tax professional can calculate the after-tax, break-even interest rate that would be necessary for this strategy to make sense.

ISN’T SOCIAL SECURITY GOING BROKE?

Social Security is a pay-as-you-go system: Revenue coming in from FICA (Federal Insurance Contributions Act) and SECA (Self-Employed Contributions Act) taxes largely cover the benefits going out. It will not run out of money if workers and employers continue to pay payroll taxes.

Social Security does face funding challenges, as the system is starting to pay out more than it takes in, largely because the retiree population is growing faster and living longer than the working population. Without changes in how Social Security is financed, the surplus is projected to run out in 2035.

Even then, Social Security won’t be broke. It will still collect tax revenue and pay benefits. But it will only have enough to pay 79% of scheduled benefits, according to the latest estimate. To avoid that outcome, Congress would need to take steps to shore up Social Security’s finances, as it did in 1983, the last time the program nearly depleted its reserves. The steps then included raising the full retirement age, increasing the payroll tax rate, and introducing an income tax on benefits.

Before you can decide when to take your retirement benefits, it’s necessary to check with the SSA to find out which benefits you’re entitled to claim. Verify your earnings history with the SSA’s records and correct any errors. Based on the Social Security benefits statement and your recent tax records, we can run financial models to help you make your decision.

| Take your benefits early | Wait until your FRA | Delay benefits up to age 70 |

|

|

|

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

Presented by Carl Holubowich